This offer is currently only addressed to commercial customers. All prices are exclusive of goods and services tax (GST).

PRODUCT OVERVIEW

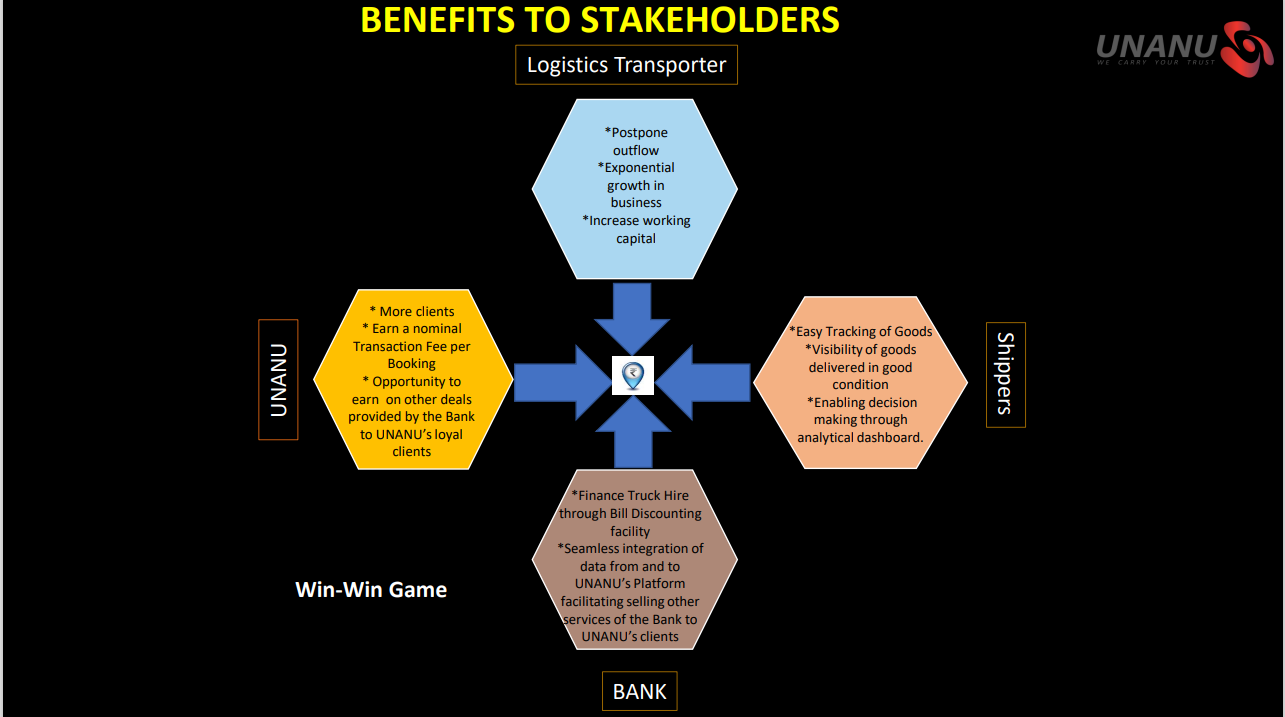

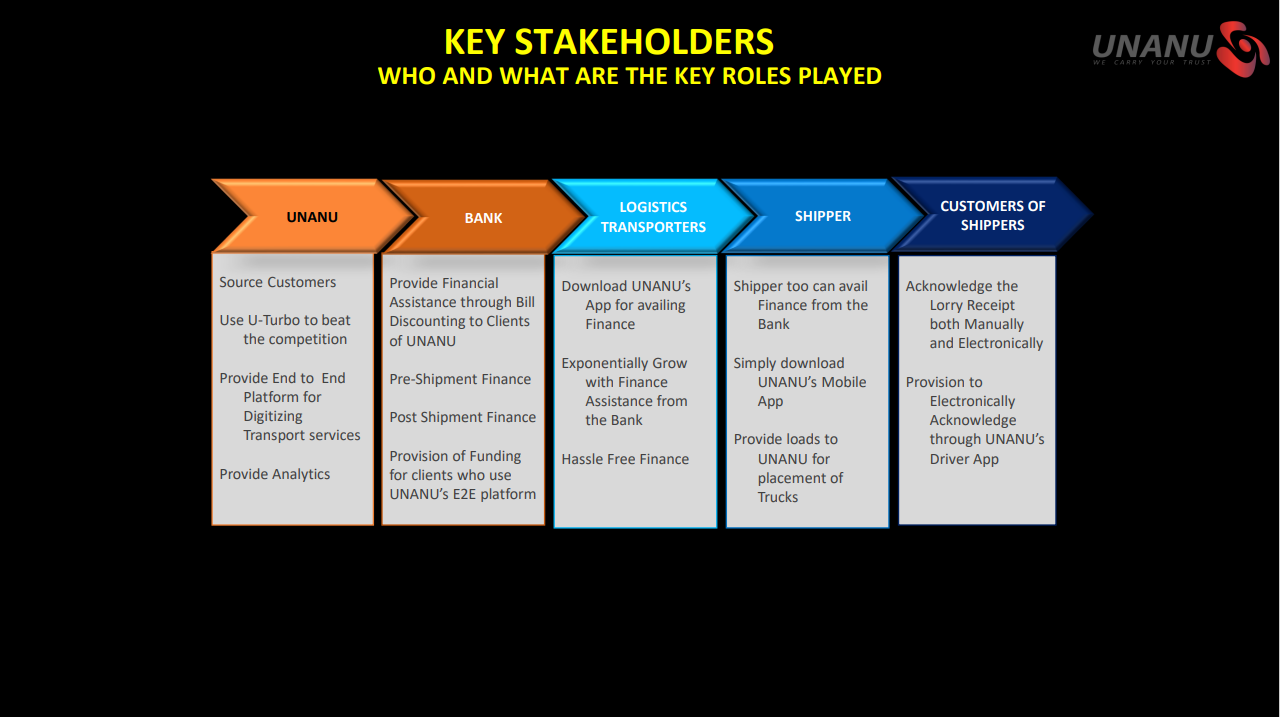

Provision of funding for clients who use UNANU’s E2E platform using digital traces of proof of pickup, proof of delivery or invoices.

PRODUCT FEATURES

UDHAN- An Overview

.svg)

Freight Financing

Visibility and availability of working capital for transport contractors

.svg)

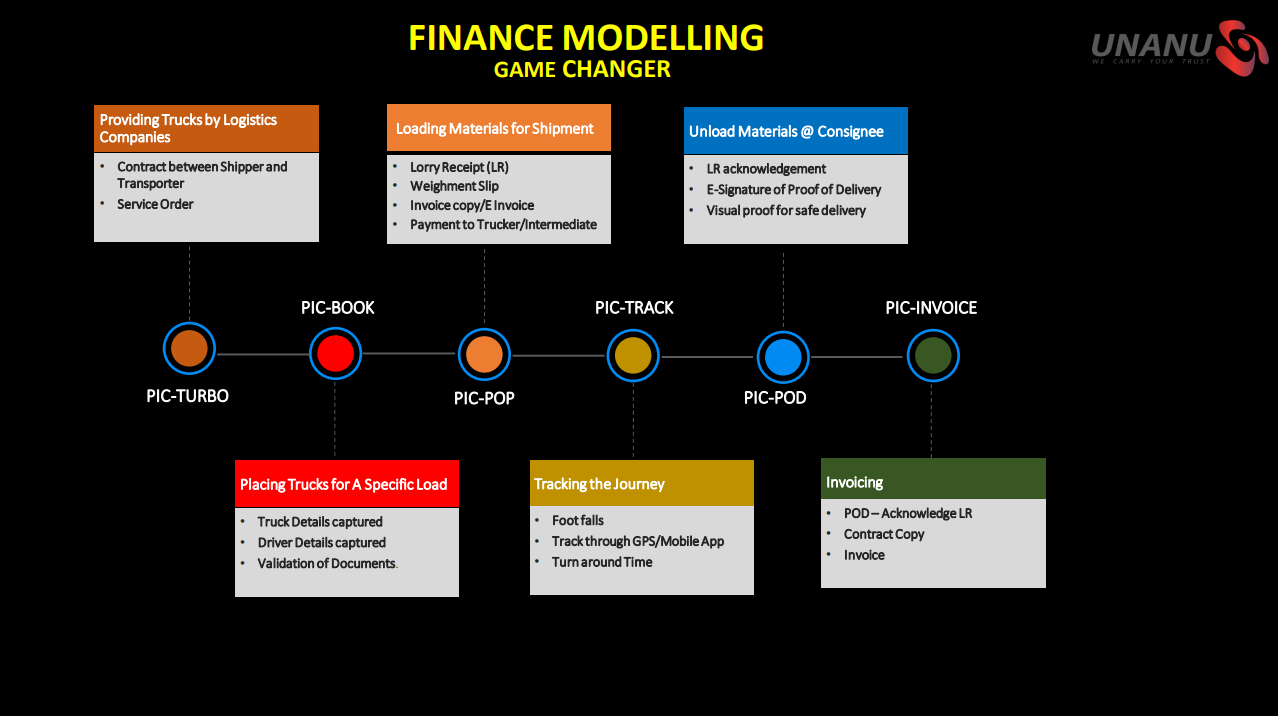

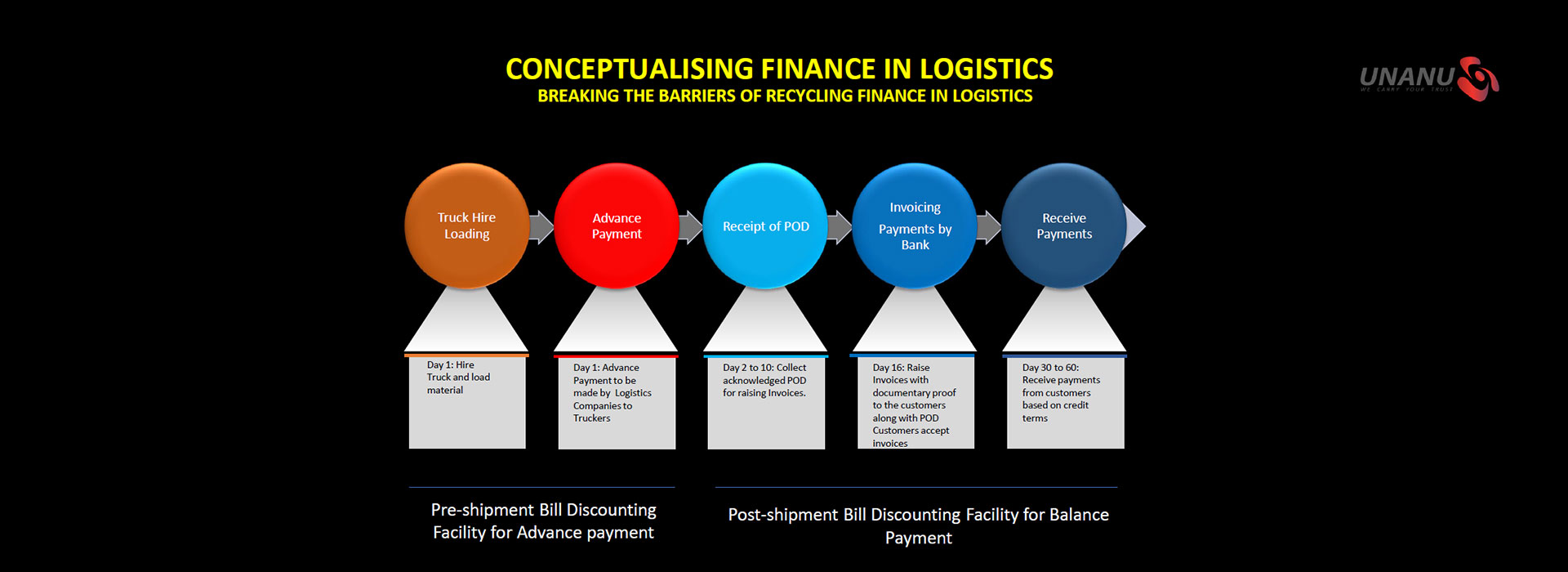

Pre-Shipment Finance

Leverage proof of pickup to finance before shipment starts

.svg)

Post Shipment Finance

Leverage proof of delivery to finance post delivery of shipment

.svg)

Bill Discounting

Invoice based discounting to transporter

We are always here to answer them. Some frequent ones being...

It is a collateral-free financing that is based on the credibility of your client contracts (A+ to AAA Rated Companies) and your company’s financial stability.

Limits are set based on the average value of transactions of the client contracts that are approved by the bank partners and can range from Rs.25 lakhs to Rs.2 crores to start with. However, these limits and approvals are at the sole discretion of our banking partners

UDHAN enables you to get funding to place more trucks and grow your business faster. Once you enrol with the platform, you will start with Proof of Delivery (PoD) based funding at the bank’s approval. After 6 months of good performance, you will get eligible for Proof of Pickup (PoP) based funding which will open the doors to place as many trucks as you may need as the funding will be released at the time of loading the truck at the start of the trip.

Freight Finance is a shipper contract based and transaction based funding, which only allows you to use the finance on the issuance of the Invoice. Bank ODs will not allow you to take more than the credit limit but in Freight financing, as long as your clients are paying you on time the finance amount can be increased by the bank to support your business growth. Once you get approval for freight financing you can also have the option to transfer your bank ODs to Freight financing account.

A one-time platform access cost, and a monthly usage fee for the platform while bank finance charges at an interest rate of 10% p.a. to 12% p.a. (depending on your client’s rating) which is calculated for the period the funds are used.